MARKET Watch

by Romulus at Grok TradeMany years ago, I went on a surf trip to Costa Rica. One of the guides was a Venezuelan with a lot of skill. His turns were smooth, he had power and he knew how to get the most from the wave. After watching him for a full day, though, I realized his cutbacks and tailspins weren’t the best part of his surf. There was something else that separated him from the pack.

His real edge was patience. He would sit out back and wait. The rest of us would paddle battle and scrap for every wave that came rolling through. The mighty Venezuelan would wait for us to jump on all the smaller waves, then a big set wave would come in and he was the only surfer left in the lineup. He would casually paddle into a bomb, then carve it up for the next 40 seconds. He was an artist with an entire ocean as his medium.

It took me a long time to fully incorporate the lessons I learned from the Venezuelan into my own surfing.

I don’t live on the beach, so when I get there my initial reaction is to jump on every wave I can, big and small alike. Then I think about that day in Costa Rica.Grow Wealth, Not Risk. Trade alongside a 27 year hedge fund veteran

September was the last time I surfed. A hurricane way out at sea was pushing in great waves, and I had 3 nearly perfect days. I didn’t catch the most waves of my life. Instead, I slowed things down and got lost in the beauty of the rising sun shimmering over the glassy water. I watched the offshore breeze feather back the tips of the waves right at the peak of their power. I sat outside waiting for the set waves, then carved them up when they rolled through. I felt smooth and strong as I picked off some of the best waves of the day. There was a level of enjoyment I’ve rarely felt my entire life.

It was sublime.

Your trading and investing can become sublime. It takes patience and a belief that great trades will present themselves. When they do, you will be in the perfect position to take advantage of them, especially if you’ve been conserving your energy, waiting for that set wave to roll through.

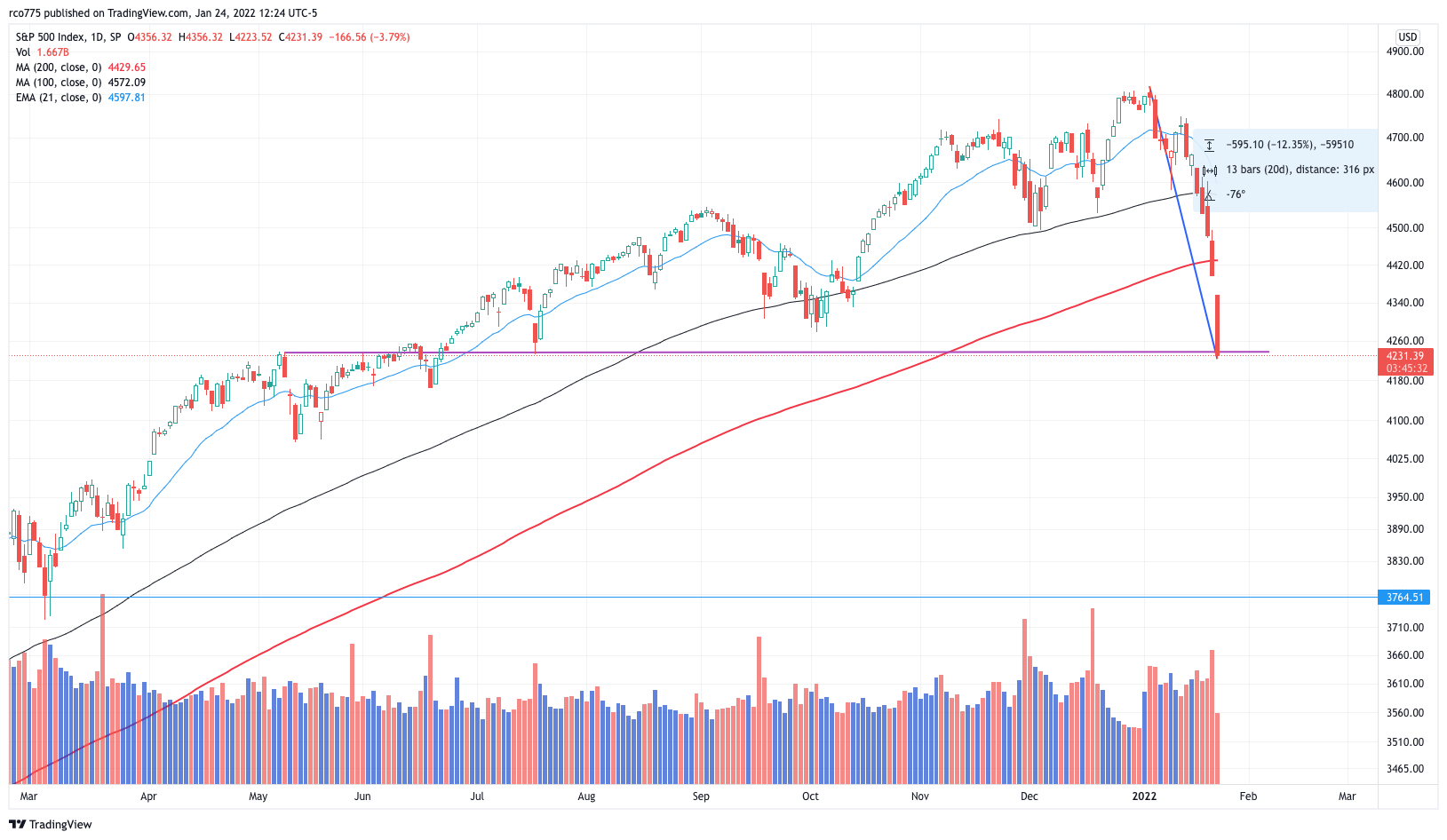

Changes are ComingThe market is beset by crosscurrents. The S&P 500 is just over 12% off its all-time high, but the small cap stocks are down over 21%. Most of the Cathy Wood, YouTube and Reddit style stocks have been completely smashed. Everyone now agrees with what I said last August that the Fed needs to tighten credit. Last week the market seems to have started to take notice.

Our best strategy is to go with the odds in front of us. At this point, technicals suggest the market could do anything in the short term. JP Morgan beat estimates the previous week and the stock fell 6%. Wells Fargo beat estimates and the stock rallied 4%. Netflix missed its earnings estimate by almost 40% and its stock dropped over 21%. Small caps led the way down last week, with the Russell 2000 index (RUT) now below a support level that had held it up since January of last year.

Club Romulus: Where knowledge plus action equals profitExamining the longer-term indicators, the picture becomes a little more definitive. Upward momentum has been slowing. The evidence points to an increasingly risky situation. The number of stocks hitting new 52-week highs peaked last May. The percent of stocks above their own 200-day moving averages also peaked in the spring. The vaunted New York Stock Exchange Index itself hit a new all-time high at the beginning of the month, but the NYSE advance/decline line representing the number of issues with rising versus falling prices stopped advancing over 2 months ago. If this keeps up a few more months, stocks will be in a seriously dangerous environment.

Speaking of the long term, many signs portend lower average returns for the next 10 years. Going back to the buttonwood tree in 1792, US stocks with dividends have averaged about 11.5% a year. The S&P went up 29% in 2019, 18% in 2020 and 28% last year. The average return over those 3 years was double what it has done for more than 200 years. There will be a reversion to the mean. I believe it begins this year.

The consequences of this idea affect every aspect of our lives.

Stock market returns are going to be much different over the next 10 years than the last 10. There will be no one starting from zero today who will go on to become worth $200 billion 10 years from now. No one. Residential real estate, which has been tremendous in the US for over a decade, will show paltry returns. National economies will change. Politics will be impacted. Crime rates will go up. Culture and fashion will go down.

Everything will change.

With expectations for a more challenging year than anything since 2018, it makes sense to expand our horizon to include the short side of the ledger. For a little over a year, my Firmus portfolio didn’t take any short trades, until May 2021. Returns have been great since then, with Firmus taking long and short trades equally. The Aquilas portfolio was heavily long right after the Covid crash, sold a bunch on Sept. 1, 2020, right before the market spent 2 months heading down, loaded up again in the middle of November and stayed heavy until May of last year. It has been mostly shorter term, tactical trades since then, but still on the long side.

That will change soon.

The Best WorstSo, in the spirit of that coming change, I present the best worst stocks for 2022.

These stocks mostly come from the online group, which has been persistently weak for months. I screened out stocks that already have high short interest because I don’t want to get caught in a short squeeze. Those events can happen even in strong bear markets. I also screened out any biotechnology stocks. That group is incredibly weak now, but the individual stocks can see crazy jumps due to FDA announcements. I avoid the group altogether.

Before venturing into this idea, check your risk appetite. These are very volatile. I would use small dollar amounts and be prepared for some fireworks. Partial profits should be taken quickly, with a stop loss placed below sale price immediately after.

You must check the weather before taking these trades. As I write this, the S&P 500 has corrected sharply and is now oversold and looking for a bounce. Volume of shares traded has been more bearish lately, along with an increasing list of longer-term bearish indicators. There are also just enough neutral to bullish indicators to be wary that the bear market will tarry further.

The weather is good for these trades right now but maintain close vigilance as that can change fast.

Due to last week's decline, the strategy is to start shorting them after they run up and become extremely overbought. Start small and commit to only 3 entries if the stock continues higher for a few days. I would use stop-losses on all these trades.

BMBL, POSH, GAN, RSKD, JMIA, UPWK, OSTK, COMP, CPNG, SNAP, SNCR, VMEO, ANGI, WIX, FTCH, BTCM, TZOO, PINS, MTCH, TSP, DOCU, TXG, PLTR, PATH, SQ, TWLO, EXAS, SHOP, SPOT, ROKU, U, TDOC

Expect a BounceTo the long side, there are opportunities to capitalize on a short term bounce in fundamentally strong stocks and sectors, like financials (XLF) to be expected within the next couple of days. Those wanting to play the S&P 500 can use its exchange traded fund, SPY. A 2% to 3% further drop from here is possible, although support is also present now. So, start small and patiently, adding to the position if it drops over the next day or two.

Related: Romulus Report: A waning bull market January 17, 2021

Related: Romulus Report: A waning bull market January 17, 2021Remember:

Wealth, like Rome, cannot be built in a day. But, like Rome, it can be lost in a day. Watch for future announcements from Romulus about profitable market moves, important indicators, and major market swings. For trading education, mentoring, or to beat the markets with Romulus' trading group, contact romulus@groktrade.com or go t0 www.groktrade.com/romulus.About the author:

In his real-life existence, Romulus started on Wall Street in 1994 and traded for a hedge fund for 13 years. Since 1994, he has called every major market top ahead of time and profited from them, including the break of the Dot-com bubble in 2000, the market crashes of 2008 and 2009, and the Covid crash of 2020. For the past 12 months he has been working with investors and traders to actively manage their portfolios by growing wealth, not risk, as a teacher and mentor working with Grok Trade, a stock trading educational company in business since 2007.

Free Press International